- Coffee & Crypto Daily

- Posts

- ☕ Bitcoin’s Bull Run Barrier 🐂 🧱

☕ Bitcoin’s Bull Run Barrier 🐂 🧱

📈 As the crypto market cap rises, can Bitcoin cross its final hurdle? 🏃♀️

Sponsor Us 📣 | Follow Us 👍 | Premium Roast ☕ | Past Editions 📰

Sometimes, we need walls.

You need four walls to make a house. You need a wall to mount your TV. And sometimes you need a 13,171-mile-long wall to repel the Mongol hordes.

But what if you’re a Mongol Khan on horseback and the wall is keeping you out?

Well, it seems that Bitcoin is in the seat of several centuries of medieval invaders.

It’s come a long way. The forces behind it are inspired. And the conditions for a bull run are perfect, if Bitcoin can just get over that final wall protecting its siege prize.

Can Bitcoin scale the ladders, avoid some flaming pitch, and jump the resistance barrier to achieve ultimate market dominance?

Espresso Shots

☕️ SBF Defense Cites English Law

Sam Bankman Fried’s defense team is trying an interesting new tactic by evoking English Law.

In a newly submitted filing, SBF’s lawyers argue that under English Law, FTX’s Terms of Service did not create a trust or binding fiduciary relationship between FTX and its customers.

Applying these principles of English law, the Terms of Service do not create a trust or similar fiduciary relationship between FTX and its customers. The Terms of Service do not use the words “trust,” “trust property,” or “beneficial interest.” To the extent that the Terms of Service use other language relevant to a trust or fiduciary relationship, they expressly provide that no fiduciary relationship is created.” The filing reads.

Though if SBF wins the case, under English Law he’ll be forced to wear a monocle and tiny bowler hat for the rest of his life.

☕️ A Billionaire’s Bitcoin Regrets

Stanley Druckenmiller, a former hedge fund manager worth about $6.2 billion, has been refreshingly candid when it comes to Bitcoin.

During the Robinhood Fireside Chat NYC with Paul Tudor Jones, Druckenmiller expressed that "I don't own any bitcoin, to be frank, but I should," and that he understand the youthful enthusiasm surrounding BTC.

“I’m 70 years old, I own gold. I was surprised that Bitcoin got going, but you know, it’s clear that the young people look at it as a store of value because it’s a lot easier to do stuff with. Seventeen years, to me, it’s a brand. I like gold because it’s a 5,000-year-old brand, but the young people have all the money, certainly the ones on the West Coast do,” Druckenmiller continued.

Druckenmiller’s decision to pass on Bitcoin is deeply reminiscent of my dad’s decision to stop playing “Pokemon GO” when it caused him to fall headfirst down the stairs.

Stanley Druckenmiller is one of the most successful hedge fund managers on Wall Street and is worth $6,200,000,000.

He says, “Young people look at #bitcoin as a store of value. It’s a brand. I like it. I dont own any, but I should”

— Documenting ₿itcoin 📄 (@DocumentingBTC)

8:24 PM • Oct 30, 2023

☕️ Bitcoin ETF Concerns

Rather than excited, some major voices are concerned about the coming potential for Bitcoin Spot ETFs.

Some crypto mining firms are concerned that the dawn of the Bitcoin Spot ETF could draw investors away from their companies and other forms of Bitcoin investing.

“Over the past few years, mining companies have been used as proxies to get access to Bitcoin exposure in the public markets,” Alex Altman, CFA and Senior Manager of Corporate Development at Foundry, told Decrypt. “It will be interesting to see how these new ETF vehicles will impact public miner valuations as investors will now have a more direct, cost-effective way to access the asset class.”

Additionally, analysts from JPMorgan have indicated that the release of similar ETF products in the Canadian and European markets didn’t revolutionize those spaces, and the American rollout may be similarly underwhelming.

What’s more, my mother is concerned that the Bitcoin Spot ETFs left the house without a jacket.

Polled Brew

Thank you Bitcoin

Today is the 15th anniversary of the release of the Bitcoin whitepaper, one of the most agnostic pieces of tech literature gifted to all

Bitcoin is one of the most powerful tools of human expression and can not be censored

It's a tool that can be used by… twitter.com/i/web/status/1…

— Wendy O (@CryptoWendyO)

2:08 PM • Oct 31, 2023

Today marks the 15th anniversary of the Bitcoin whitepaper. What secret text was hidden in the first block of the Bitcoin blockchain? |

Spilling the Beans

Bitcoin’s Bull Run Barrier 🐂 🧱

Bitcoin’s been on a long journey. There have been peaks, valleys, and a perilous winter, but Bitcoin has finally made it to the promised land.

Market enthusiasm is steadily building as Bitcoin’s price climbs and investors eagerly await the approval of Bitcoin Spot ETFs.

We’ve all been reinvigorated as Bitcoin rose up to and past the $34,000 mark.

Bitcoin market dominance is currently at 53% of the total crypto market, occasionally reaching 54% over the past week.

Yes, Bitcoin’s leading the charge, but much as a rising tide lifts all boats, Bitcoin’s activity is ushering the entire market into an era of plenty.

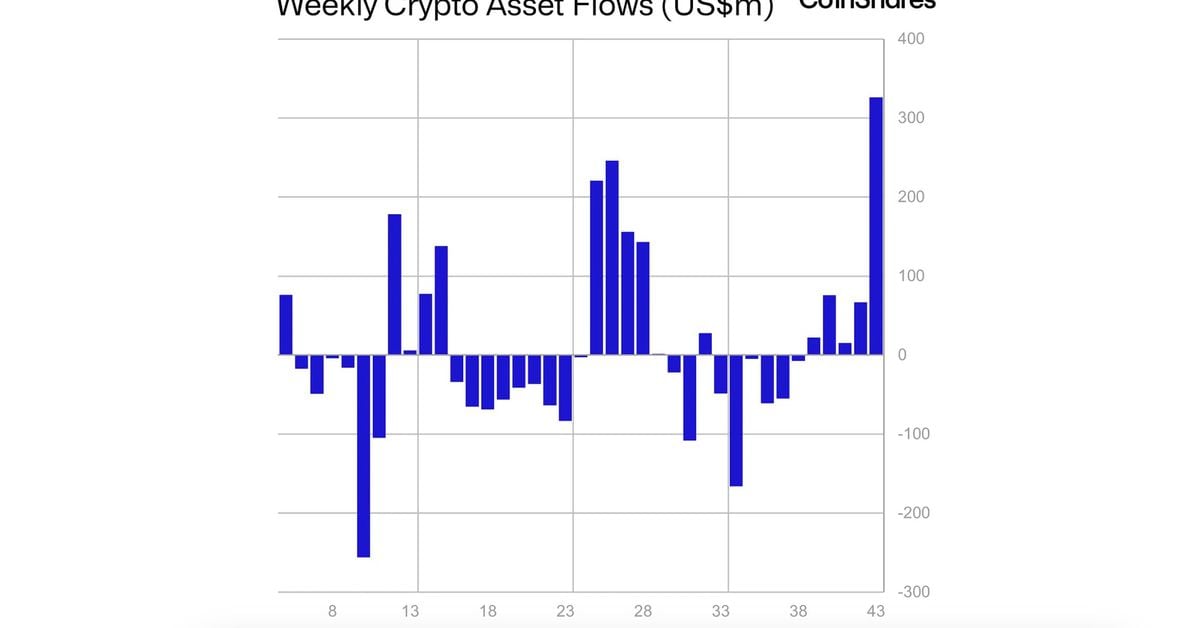

In the past week, crypto investment funds witnessed net inflows of $326 million. That’s the highest level in fifteen months.

Total #Crypto Market Cap Looking SPICE

— Tom Crown (@TomCrownCrypto)

9:03 PM • Oct 29, 2023

Right now, it feels like nothing can stop Bitcoin mooning.

But Bitcoin’s about to enter a region where, historically, it’s had some issues.

Previous patterns and performance indicators show that Bitcoin’s resistance barrier is at 58%.

What does that mean?

A resistance barrier in the traditional stock market is a theoretical line drawn on a stock’s upward performance, which indicates when it’s going to struggle to gain ground.

It’s the result of supply catching up with demand. On one level, it’s sort of a nice problem to have. It’s a result of an asset doing so well that it’s literally struggling to do better.

We saw this in 2017 when Bitcoin hit 58% market dominance.

Bitcoin resistance ushered in “Altcoin Season” as investor attention shifted to cryptocurrencies which promised more rapid gains.

Bitcoin languished and dropped to 35% dominance before bouncing back up to 73%.

Now, there’s a strong possibility that this sort of behavior could occur again. As Bitcoin reclaims its titan status, investors may adopt more maverick thinking and shift focus to the competitive performance of Ethereum, Chainlink, or Solana.

Chart from NewsBTC

However, some factors could alter this behavior.

Both the upcoming halving event and the widespread adoption of Bitcoin Spot ETFs could push Bitcoin through the 58% resistance barrier and to levels of unprecedented market dominance.

If Bitcoin can push through this final barrier, not just Bitcoin, but all of crypto will be in the land of milk and honey.

It’s kind of like when my friend Steve jumped the barrier at a Ravens game and streaked naked across the field. Yes, crossing that barrier got him banned from M&T Bank Stadium for life, but his glorious moment will live on forever, burned into the eyes of the unsuspecting crowd.

Crypto 101

Altcoin Season: Any period when investor attention and money both flow out of Bitcoin and into Altcoins, resulting in a rapid and remarkable increase in value.

The Last Sip

The Last Sip: So, we missed the Facebook alert, and forgot the 15th birthday of the Bitcoin White Papers on Halloween. Happy Belated Birthday Bitcoin. Unfortunately, now that Bitcoin is fifteen, it’s going to enter its angsty phase when it discovers it’s too old to Trick or Treat.

Stay Caffeinated,

Coffee & Crypto Team

That's all for today! If this email got you hooked on our unhinged crypto takes, be sure to get a full dose on Twitter @GetCoffeeCrypto.

Want cutting-edge market analysis delivered to your inbox three times a week? Sign up for Premium Roast! We'll cut through the BS floating around on Twitter and CNBC and help you finally understand the markets, all for the price of a single cup of coffee.

If you find yourself smiling at any of our dumb jokes, or even *learning* something - make sure to share this newsletter with your friends!

If you get 5 friends to sign up - or even enemies, we don't care - we'll send you our Bitcoin Bootcamp Ebook! This thing is packed with info and is the ultimate guide to the world’s ultimate currency.

Just hit the Click to Share button in the section below to get started!

What did you think of today's newsletter?It's ok, you won't hurt our feelings. |

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.