- Coffee & Crypto Daily

- Posts

- ☕️ Banks Are Falling. Bitcoin is Climbing 😳 🚀

☕️ Banks Are Falling. Bitcoin is Climbing 😳 🚀

While banks falter, Bitcoin is suddenly more appealing than ever 👀

Whether it’s a posse of desperados, a hostage situation involving Al Pacino, or merely a paint bomb going off accidentally, it seems like banks are always getting into trouble.

But what if another tool could cut through banking’s problems? What if there was a financial tool built to rise above it all?

It turns out… there is, and we’ll give you three guesses which financial “hero” we’re talking about. All that and more in today’s newsletter. Read on, valiant subscriber!

Espresso Shots

☕️ USDC Repegs! (Mostly) 📈 💵

After depegging in the wake of the collapse of Silicon Valley Bank and Silvergate, Circle’s USDC coin has climbed its way back… almost.

USDC is currently sitting at about 99 cents, which, yes, is less than a dollar. Despite that, after falling to 88 cents, USDC looks sure to fully regain its dollar peg.

USDC depegged this weekend when investors discovered over $3 Billion in Circle’s assets were held by Silicon Valley Bank. Upon news of the recovery of those funds, the stablecoin has resumed its stability.

“Broadly speaking, people are confident that the current issues that Circle is facing will get resolved without any large negative financial implication,” said Martin Lee, a crypto journalist.

Crypto Market confidence has been further bolstered by the fact that on Monday, an additional $407.8 million in USDC was minted.

That means a Circle user deposited an equivalent amount of cash in a Circle account to mint those tokens.

Circle’s new found success is only drawing further resentment from lesser known rivals such as Parallelogram and Trapezoid Inc.

☕️ Silicon Valley Customers Access Funds 🏦 🎉

Starting Monday morning, those with deposits at the now defunct Silicon Valley Bank, were able to withdraw their funds.

This is the result of action taken by the Federal Deposit Insurance Corp. which successfully transferred the funds to a newly established bridge bank.

The FDIC has also appointed Tim Mayopoulos, ex-CEO of mortgage financier, Fannie Mae, as the CEO of the bridge bank.

An official statement by the FDIC claimed, “All depositors of the institution will be made whole, no losses associated with the resolution of Silicon Valley Bank will be borne by taxpayers.”

Now that the bridge bank is fully functional, the FDIC can focus on their collaboration with makeup brand, Maybelline.

“Maybe she’s born with it, maybe it will be borne by taxpayers.”

☕️ Signature Bank: A Warning for Crypto? ✍🏼 😳

New York Regulators shut down Signature Bank on Sunday, making Signature the freshest grave in the steadily growing banking graveyard.

Signature, like Silicon Valley and Silvergate, was a crypto-friendly bank, with exchanges such as Coinbase and Paxos holding $240 and $250 million at Signature, respectively.

The regulators behind the closure cited “system risk,” but haven’t been able to offer further explanation. Barney Frank, a former United States Representative who sits on the board of Signature Bank, thinks he knows the reason.

“I think part of what happened was that regulators wanted to send a very strong anti-crypto message,” said Frank. Frank feels that New York regulators were targeting a “poster boy” for crypto banking.

But if regulators really wanted to send a strong anti-crypto message, they wouldn’t have shut down a bank. They would have sent a severed horse head or shot an arrow with a piece of parchment on it.

Spilling the Beans

Bitcoin vs Banking 💥

It would seem that American banks are in trouble. Well, not all of them… just the little guys.

The big guys, Bank of America, Chase, Wells Fargo, they all seem to be doing fine. It’s almost like they’re… too big to fail? You’ve heard this one before.

This banking epidemic seems only to be targeting small banks. Specifically… small crypto and tech friendly banks.

First Silvergate. Then Silicon Valley Bank. Now Signature Bank. All of the victims have been banks that did substantial business within the tech and crypto space.

In our initial diagnosis of the situation, we urged you not to panic. Panic breeds panic and, as we saw this weekend, it leads to bank runs.

We’re all still hoping this situation has already hit its climax, but only time will tell. As it stands, Monday saw more bank stocks getting hammered, but no additional closures.

Monday also saw something rather peculiar in crypto… green arrows and massive gains. That’s right, despite banking panic (or rather because of,) crypto is crushing it.

While the banking world is in an uproar as a result of the Fed’s rate hikes and taxpayers everywhere are getting heated over bank bailouts, crypto is climbing.

Crypto has been soaring above the smoke with Bitcoin surging up 20% and bringing all of crypto up with it. Which, in a lot of ways, makes sense.

At the time of this writing, Bitcoin is safely above $24,000, a huge gain from Friday when Bitcoin was languishing at below $20,000.

And it’s impossible not to note that all of this occurred while American Banks were experiencing their worst few days since 2008. Which makes sense.

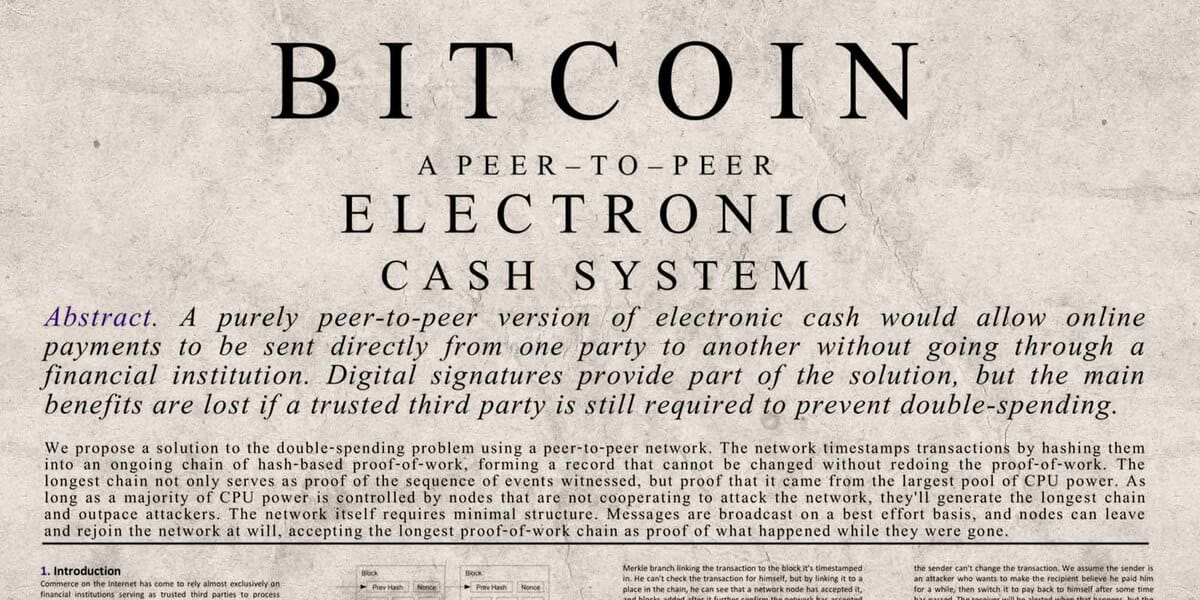

Crypto was created in response to the 2008 financial crisis.

It was specifically created to do away with things like bank bailouts and governments printing money to solve problems.

Bitcoin is finite and it can’t be “closed” by anyone. While banking is feeling scarier than it has in years, Bitcoin is looking awfully appealing.

Meanwhile, in the world of traditional finance, the Biden administration has assured the public that individuals and companies affected, will have their assets fully restored.

Other investors and the management of those banks may not be so lucky.

“The management of these banks will be fired. If the bank is taken over by FDIC, the people running the bank should not work there anymore,” said Biden.

“Investors in the banks will not be protected, they knowingly took a risk. And when the risk didn’t pay off, investors lose their money. That’s how capitalism works.”

And why do these individuals need to be punished? To avoid accusations of a bank bailout.

Because don’t get it twisted, this is, in many ways, a bailout. These banks couldn’t afford to fund customer withdrawals, and so the US government is guaranteeing those withdrawals.

So, why is the government protecting these banks?

Well - in short - because they have to. The White House urgently wants to prevent a nationwide bank run, and if people don’t trust their banks, they will run to withdraw funds.

Sure, the government won’t save bankers, but they are protecting them from facing consequences by stepping in and taking over.

As the editorial board of The Wall Street Journal put it, “This is a de facto bailout of the banking system, even as regulators and Biden officials have been telling us that the economy is great and there was nothing to worry about.”

It’s not incredibly clear that the economy is not great.

But meanwhile, back in the idyllic world of crypto, things are looking rosier than ever. The proof point for Bitcoin is clearer than ever too.

Crypto and traditional banking have always stood at odds. Ultimately they’re divergent paths at a fork in the road: one is a clear rebuke of the other.

These past few days have proven that banks and the US government can always print you another dollar if they lose it. But how much will that dollar be worth?

Currency can be devalued. Banks can go defunct. That’s the argument for Bitcoin: It’s finite, it’s yours, it’s immutable.

Meme of the Day

Crypto is here to save the day! Actually!

Did fed rate hikes accidentally start the crypto bull run...?

— Coffee & Crypto Daily (@GetCoffeeCrypto)

12:55 AM • Mar 14, 2023

Crypto 101

Bridge Bank: Bridge banks are temporary operations created by a central bank or national financial institution.

These shell organizations will take over the operations of a failed bank in the interim until a buyer can be found.

Bridge banks are an orderly system to combat the natural chaos that results from a bank going belly up due to a bank run, which is exactly what happened to Silicon Valley Bank.

The Last Sip

Barney Frank thinks that Signature was shut down as a message to the crypto industry. Here are some other major company closures that were really secret, encoded messages:

Blockbuster: If you’re not going to rewind your VHS, you’re not allowed to have it at all.

Circuit City: The entire world needs to adopt a universal plug. This was an unheard threat to the world.

Borders Books: If you’re going to have open borders, this country cannot sustain two bookstore chains.

Stay Caffeinated,

Coffee & Crypto Team

That's all for today! If this email got you hooked on our unhinged crypto takes, be sure to get a full dose on Twitter @GetCoffeeCrypto.

If you find yourself smiling at any of our dumb jokes, or even *learning* something - make sure to share this newsletter with your friends!

If you get 10 friends to sign up - or even enemies, we don't care - we'll send you a swag box with some epic Coffee & Crypto merch! Just hit the Click to Share button in the section below to get started!

What did you think of today's newsletter?It's ok, you won't hurt our feelings. |

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.